With the growing popularity of CFD (Contracts for Difference) trading, the number of online platforms available to traders has expanded considerably. Choosing the right platform is essential, as it directly impacts trading performance, market access, and overall user experience. Here are some key factors to consider when selecting an online CFD trading platform.

With the growing popularity of CFD (Contracts for Difference) trading, the number of online platforms available to traders has expanded considerably. Choosing the right platform is essential, as it directly impacts trading performance, market access, and overall user experience. Here are some key factors to consider when selecting an online CFD trading platform.

1. Platform Technology and Execution Speed

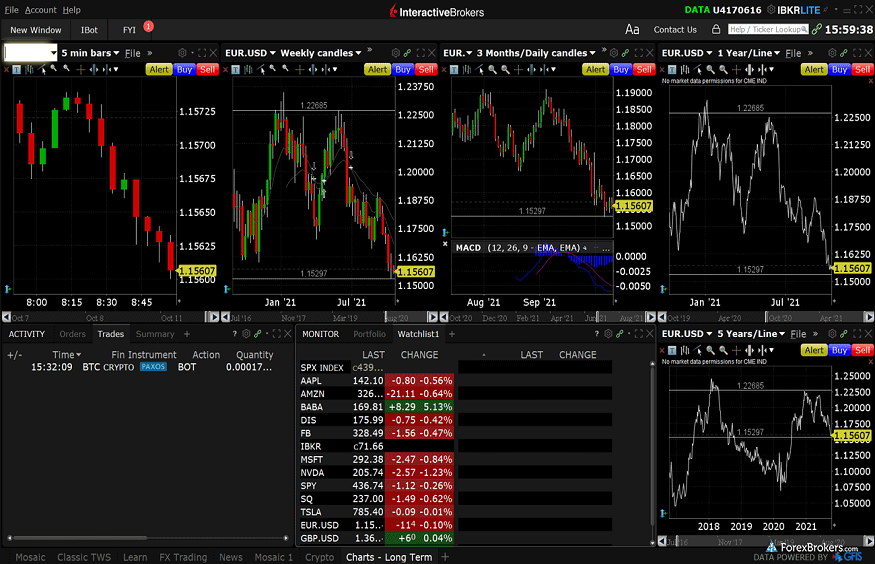

In online CFD trading, rapid execution is crucial since market opportunities can be fleeting. A platform with high-speed execution ensures trades are processed quickly and accurately, reducing slippage and helping traders capitalize on even minor price movements. Additionally, a user-friendly interface combined with advanced functionality, such as customizable indicators and charting tools, enhances the trading experience by making it easier to analyze markets and make informed decisions.

2. Access to Financial Resources and Market Liquidity

A reputable CFD broker should have established connections with major liquidity providers, which allows for better trading conditions and tighter spreads. By partnering with high-quality liquidity sources, brokers can provide competitive pricing that significantly impacts profit margins, especially when trading with leverage. This access to deep liquidity is critical for managing trades effectively and ensuring reliable market access.

3. Range of Tradable Assets

A diverse selection of tradable assets is another important consideration. An ideal CFD platform should offer access to a variety of markets, including stocks, indices, commodities, and cryptocurrencies. This diversity allows traders to broaden their investment opportunities and manage risk by diversifying their portfolios. If a trader is interested in specific markets, they should confirm that the platform provides comprehensive access to those assets.

4. Transparency of Fees and Costs

Transparency regarding trading costs, such as spreads, overnight fees, and inactivity charges, is crucial. While some platforms may offer low fees, they might compromise on features or support, which could ultimately impact trading performance. It’s essential to balance cost-effectiveness with quality. Traders should review all associated costs carefully to ensure they align with their trading strategy and budget, allowing them to make informed decisions without unexpected expenses.

5. Risk Management Tools

Due to the leverage involved in CFD trading, risk management is paramount. Quality platforms provide various risk control tools, such as stop-loss orders, take-profit options, and negative balance protection. These features help traders manage exposure and limit losses in volatile market conditions. Platforms with robust risk management options enable traders to approach the market with confidence, helping them safeguard their capital and focus on long-term success.

6. Quality of Customer Support

Effective customer support is a vital feature that is often overlooked. Traders may encounter technical issues, need assistance with transactions, or require clarification on fees. Choosing a platform that offers responsive customer service across multiple channels—such as phone, email, and chat—ensures that traders can quickly resolve any issues. Accessible support can make a significant difference in a trader’s experience, especially when facing urgent or unexpected challenges.

7. Regulatory Compliance and Security

Regulation is a key aspect of platform reliability. Working with a broker that adheres to strict regulatory standards adds a layer of security for traders, as regulations require brokers to separate client funds from company assets and to maintain transparent, audited operations. Traders should seek out brokers regulated by reputable authorities to ensure the safety of their investments.

In conclusion, selecting the best online CFD trading platform requires a careful evaluation of each platform’s technology, market access, asset diversity, fee transparency, risk management features, customer support, and regulatory status. By considering these factors, traders can choose a platform that meets their needs, enhances their trading experience, and ultimately supports their goals in the fast-paced world of CFD trading.